Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or domestic trust for which he or she acts. The Form 1040 is one of the simplest forms available to accurately and.

Malaysia Personal Income Tax Guide 2020 Ya 2019

7 Tips To File Malaysian Income Tax For Beginners

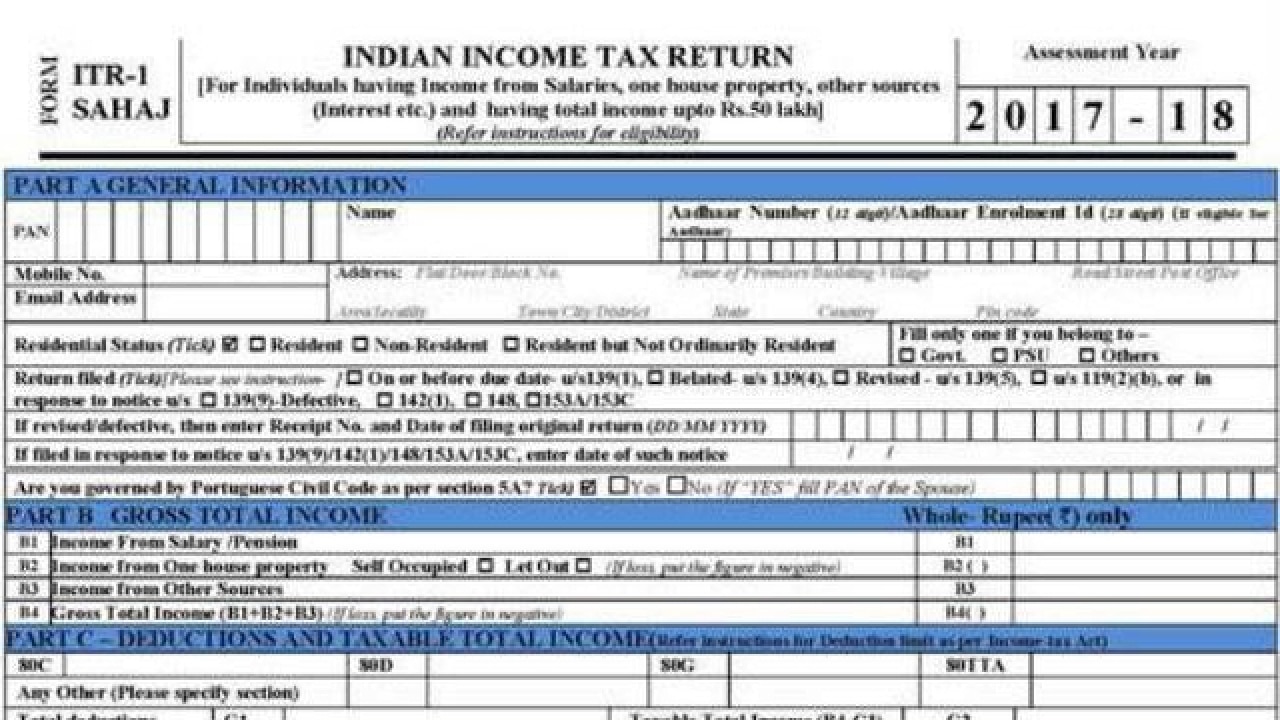

Simplified One Page Form How To File Your Income Tax Returns Itr From April 1 2017

3101153 Form 540 C1 2015 Side 1 TAXABLE YEAR 2015 California Resident Income Tax Return FORM 540 Fiscal y.

Be form income tax. Form D-400V Pay individual income tax Pay a balance due on your Individual Income Tax Return for the current tax year and prior years through tax year 2003. Personal income tax return filed by resident taxpayers. Your SSN or ITIN.

By referring to the Form 16 an Individual can fill up the Income tax Form in a better way. This form is for income earned in tax year 2020 with tax returns due in April 2021We will update this page with a new version of the form for 2022 as soon as it is made available by the Federal government. Individual Income Tax Return and it will be used by people who need to file their yearly income tax return.

Income tax and chose to apply the overpayment to your 2021 estimated income tax that overpayment may be partially or fully applied to any installment. Forms 1 and 1NPR are Forms used for the Tax Amendment. Enter month of year end.

Your Arizona taxable income is 50000 or more regardless of filing status. Form 37 DRAFT Individual Municipal Income Tax Return. Amend or change you accepted Wisconsin State Income Tax Return for the current or previous Tax Year you need to complete Form 1 residents or 1NPR nonresidents and part-year residents.

Exemption Use this form if you are exempt from filing an Individual Municipal Income Tax Return. General partnerships report their income on IT-65 and. Income Tax Return for Estates and Trusts including recent updates related forms and instructions on how to file.

SpousesRDPs SSN or ITIN. Information about Form 1041 US. The Form 1040 is used for tax filing purposes.

If joint tax return spousesRDPs first name. A Form 16 helps an Individual file his Income tax return easily. You are making adjustments to income.

Individual Income Tax Return including recent updates related forms and instructions on how to file. California Resident Income Tax Return. Form 32 EST-EXT Estimated Income Tax andor Extension of Time to File.

Income Tax Returns ITR e filing 2021 - E-filing of Income Tax Returns online made easy with ClearTax. FARMERS FISHERMEN and MERCHANT SEAMEN If the qualifications of a farmer fisherman or merchant seaman are met you only need to file Payment Voucher 4 by January 15 2022. You may file Form 140 only if you and your spouse if married filing a joint return are full year residents of Arizona.

Your Arizona taxable income is 50000 or more regardless of filing status. The type of income tax form your company uses will depend on how the business is organized. Your DOB mmddyyyy SpousesRDPs DOB mmddyyyy Your prior name see instructions SpousesRDPs prior name see instructions Single.

We last updated Federal Form 1040 in July 2021 from the Federal Internal Revenue Service. Form 1040 is used by citizens or residents of the United States to file an annual income tax return. The income of a sole proprietor is reported on one of the IT-40 series of forms.

You may file Form 140 only if you and your spouse if married filing a joint return are full year residents of Arizona. The form is known as a US. You are making adjustments to income.

If your California filing status is different from your federal filing status check. For assistance in determining how to organize your business contact an attorney or the Indiana Small Business Development Center. You must use Form 140 if any of the following apply.

You must use Form 140 if any of the following apply. Personal income tax return filed by resident taxpayers. Upload form-16 viewdownload form 26AS review your TDS deductions track refund status for income tax filing in India.

The form will be received and recorded by the United States Internal Revenue Service. 31st December 2021 is the due date to. Information about Form 1040 US.

Fillable Online Form Income Taxd17020860 Income Tax Return Annex 7 Income From Investment Fiscal Year Iro Name Source Country If Other Than Nepal Estimate Return Revised Estimate Return Selfassessment Return As Per

Ez Hasil Gov My

Malaysia Personal Income Tax Guide 2021 Ya 2020

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Income Tax Return Form Bd Fill Online Printable Fillable Blank Pdffiller Tax Forms Income Tax Income Tax Return

Income Tax Dept Revises Form 16 Here S All You Need To Know Business Standard News

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

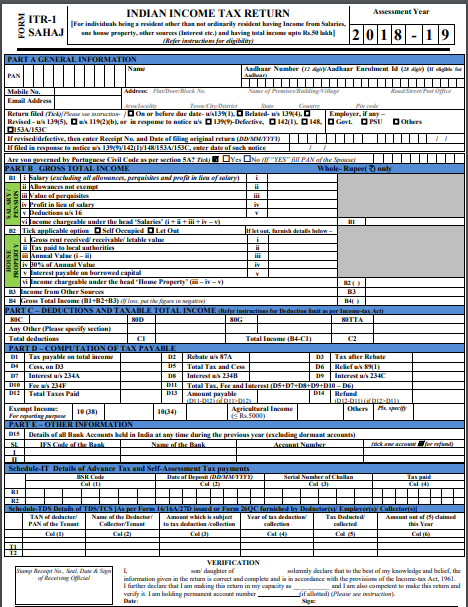

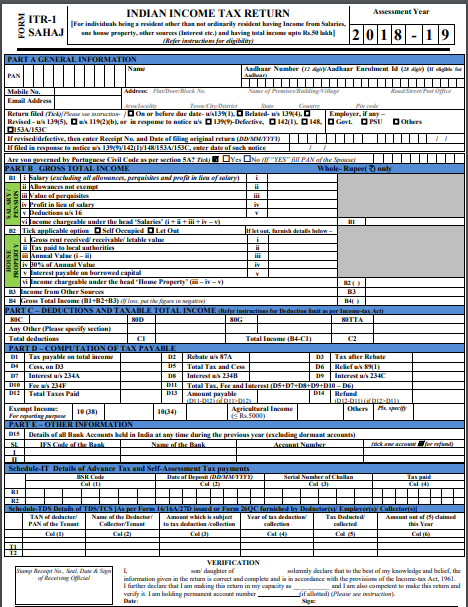

Income Tax Return Form New Itr Forms Notified Salary Breakup Gstin To Be Furnished Times Of India