The executor accounting to beneficiaries is a critical part of the executors dutiesand it must be done properly. NFSA Cards Beneficiaries Welfare Institution WIHostels Allotment Under WIHostels Allotment NFSA Rice Wheat Allotment NFSA SKOil Beneficiaries.

Trust Distribution Template

Reporting Foreign Trust And Estate Distributions To U S Beneficiaries Part 3

Sample Letter To Beneficiaries Distribution Of Funds Fill Online Printable Fillable Blank Pdffiller

Therefore completing distribution of estate to Beneficiaries between six to 12 months from the date of death is a general guide.

Distribution to beneficiaries. Trust Fund Distribution to Beneficiaries If you are a beneficiary of a family Trust fund then there are a myriad of topics to understand how trust fund distribution to beneficiaries occurs. The time of the first required distribution will depend on the beneficiary type and whether the original account owner died before on or after the required beginning date RBD. Outright distributions make Trust asset distribution easy and tend to have nominal feesIn this case assets are simply given without any restrictions to the beneficiaries upon the death of the Trust creator once all the estates debts and taxes are paid.

While it is not usually required a proposal is a good idea if probate has been contested. Right to an accounting. Before you distribute any property you might choose to send a proposal for distribution to all the beneficiaries.

Beneficiaries are responsible for withdrawing the correct amount of RMDs from the inherited IRA within the appropriate time period in order to avoid IRS penalties. Otherwise distributions will be based on the oldest beneficiary. Trust Fund Distribution Letter A Trust fund distribution letter can be used by the Trustee you appoint to inform beneficiaries when all of the Trust assets have been distributed.

While it may not seem like a lot. I I N GENERALAny individual who receives a qualified birth or adoption distribution may make one or more contributions in an aggregate amount not to exceed the amount of such distribution to an applicable eligible retirement plan of which such individual is a beneficiary and to which a rollover contribution of such distribution could be made under section 402c 403a4 403b8. Robbery victims single mothers among beneficiaries of Govts hamper distribution exercise.

There isnt a standard way of distributing trust assets to beneficiaries but rather the grantor the person who creates the trust also known as the settlor or trustor determines how the trust assets should be disbursedThe trust can pay out a lump sum or percentage of the funds make incremental payments throughout the years or even make distributions based on the trustees. As executor its a good idea to keep everyone abreast of the process as it proceeds. How to Distribute Trust Assets to Beneficiaries.

Human Services Minister Dr Vindhya Persaud during the hamper distribution exercise at Port Mourant. If you are reporting a distribution from a Coverdell ESA that includes a returned contribution plus earnings you should file two Forms 1099-Q one to report the returned contribution plus earnings the other to report the distribution of the other part of the account. Trusts are incredibly useful estate planning vehicles but they come with a fair number of complicating factors.

This means is that if beneficiaries have questions about whats in the estate or your plan to pay off any debts you owe them an answer. Another responsibility the executor has is to distribute assets to the beneficiaries in a timely. Lacson said poor planning and a list of beneficiaries based on the 2015 census of the Philippine Statistics Authority contributed to the troubles in.

If a spouse is the sole beneficiary of a retirement account one set of distribution rules apply. Distributing the estate. You see the distribution of trust assets to beneficiaries happens when the Trustee and if applicable the Co-Trustee meet all their fiduciary duty.

However depending on your situation the size and complexity of the estate and possible disputes requiring additional time may be reasonable. Depending on the type of trust and applicable state law the trustee may want to send a proposal for distribution to the beneficiaries or make a written agreement with the beneficiaries regarding how trust assets will be distributed. It takes place after all expenses and debts have been paid including income taxes and before the remainder of the estate is distributed.

Current beneficiaries are entitled to an accounting. Beneficiaries are either named specifically in these documents or have met the stipulations that make them eligible for whatever distribution is specified. Once probate or administration has been granted or if it was not needed and a notice of intended distribution has been published the executor or administrator or next of kin can distribute the estate after paying the deceaseds debts.

If multiple beneficiaries separate accounts must be established by 1231 of the year following the year of death. For example if you inherit a portion of real estate from the decedent you must sign a deed accepting that real estate. Like the staggered distribution method discretionary distributions can result in higher administration costs because the Trust could take years to deplete.

You should file a separate Form 1099-Q for any trustee-to-trustee transfer. Prepare a proposal for distribution. Current beneficiaries have the right to distributions as set forth in the trust document.

If a spouse is among other beneficiariesor if no beneficiary is a spousethen different rules. Under the Social Security Pension Scheme 159 beneficiaries of the State Old Age Pension Scheme were given benefitsWheel Chair 4 Green Card 10 Conversion Letter Distribution 25 Forest Patta 2. Beneficiaries often must sign off on the inheritance they receive to acknowledge receipt of the distribution.

Distribution of Trust Assets to Beneficiaries In the state of Arizona trust administration is governed by ARS Title 14 Chapter 7. Either before or simultaneously with sending the Estate Distribution Letter the executor or personal representative may be required to file an accounting with the probate court or provide an accounting to the heirs and beneficiaries or others with an interest in decedents estate. Another hurdle for beneficiaries of traditional IRAs is figuring out if the benefactor had taken his or her required minimum distribution RMD in the year of death.

Required Minimum Distributions RMDs are mandatory and you are taxed on each distribution. Before sending a final Trust Distribution Letter to the beneficiaries and closing a trust the following steps should typically be completed. Current and remainder beneficiaries have the right to be provided enough information about the trust and its administration to know how to enforce their rights.

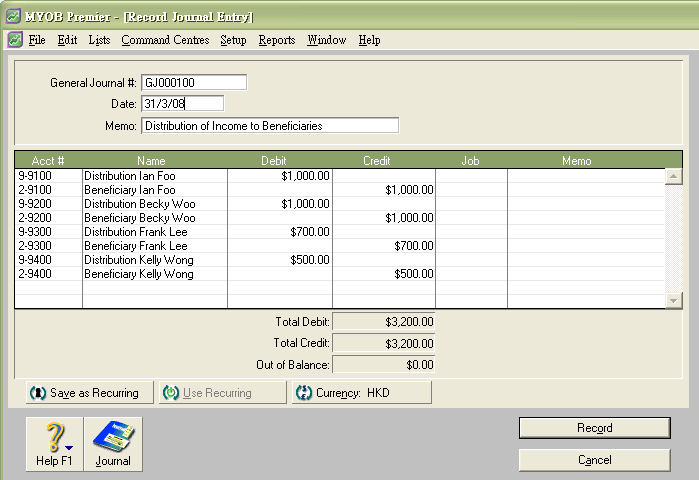

Distributions To Trust Beneficiaries Myob Essentials Accounting Myob Help Centre

Distributions To Trust Beneficiaries Myob Essentials Accounting Myob Help Centre

Beneficiaries Await At A Fao Distribution Herders Sit Atop Flickr

Distribution Trusts Profit Abss Support

Proper Distribution Of Trust Assets To Beneficiaries Albertson Davidson

Geographic Distribution Of Beneficiaries On Behance

Distributions To Trust Beneficiaries Support Notes Myob Accountright V19 Myob Help Centre

Types Of Contracts Distribution Of Trust Assets To Beneficiaries